heloc draw period repayment calculator

This calculator is for illustration purposes only additional terms and conditions may apply. Interest rates on HELOCs are often variable tied to published market rates and currently range from a low of 25 to as much as 21.

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

For a HELOC the interest rate is typically a lenders prime rate 05.

. The third column can be thought of as the draw period on a HELOC where the homeowner is making the minimum monthly payment. In the repayment period you have to pay back the principal and interest on the HELOC. If you have a variable-rate HELOC your payments could change during the course of repayment as your interest rate fluctuates.

Calculating your HELOC payments is a tad more complicated than home equity loan calculations. HELOCs have two parts. Important HELOC factors to consider.

A home equity line of credit is the most flexible type of home financing available. HELOCs are usually set up as adjustable-rate loans during the draw period but often convert to a fixed-rate during the repayment phase. HELOCs typically have a.

This can be helpful if you will only be able to make a repayment sometime in the future like in the case of renovating your home. The two major reasons for this are the fact that you dont have to repay any principal during the draw period and they have interest rates that are adjustable. 10 year draw period layer followed by a 20-year repayment period layer No cost to apply.

A draw period during which you can borrow against the line of credit as you wish and a repayment period during which you must repay the money youve borrowed. However at the end of the draw period the interest and principal will be rolled into one amortized monthly payment for a loan term of 15 years. A HELOC has two phases.

A 15-year HELOC with a 20000 limit at five percent interest will require a payment of 160 per month. Our home equity lines of credit have no application fee no closing costs on lines up to 1000000 and no annual fees Footnote 1 1. You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only.

This type of home loan allows you to borrow a fixed amount against the equity in your home by refinancing your current mortgage into a new home loan for. While the draw period usually lasts 5-10 years the repayment period is typically. With a HELOC you can make interest-only payments significantly reducing the amount you have to pay back each month.

Following the draw periods expiration the repayment period begins. First is the draw period during which you borrow money and make payments against the interest. The Repayment Period.

During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line. When you pay off part of the principal the funds return to your line amount. Bank charges an annual fee of up to 90 after the first year unless you sign up for the banks Platinum Checking Package then its waived but you may have to pay a monthly maintenance.

HELOC Calculator How much home equity can you access. The second column can be thought of as the draw period on a HELOC where the homeowner is making amortizing payments or the repayment period on a HELOC if it still uses a variable interest rate. A HELOC has two phases.

Then comes the repayment period when. The repayment period typically lasts 20 years. As you approach the end of your draw period confirm the balance you will owe after the HELOC closes how long your repayment period lasts and what your monthly payments will be.

The HELOC calculator offers three different calculation types. You have to pay interest on your line of credit during the draw period but Wells Fargo is reasonably flexible when it comes repayment of home equity lines of credit. During the draw period you can borrow from the credit line by check transfer or a.

However most HELOCs cap how much the interest rate can rise at one. However their home equity lines of credit are very predictable and you can use the calculator tools on their website to determine how much credit you might be eligible for and get a better idea on your interest rates. Enter some basic information to see how much equity you could tap into.

The interest-only repayment option is an attractive feature of a HELOC. The lengths of your draw period and repayment period will be specified in the HELOC loan agreement. In terms of the HELOC you typically only need to make interest repayments during the draw period which is usually between 10-15 years.

Get more with a HELOC. Lenders typically loan up to 80 LTV though lenders vary how much they are willing to loan based on broader market conditions the credit score of the borrower and their existing relationship. When your repayment period hits however youll no longer be able to draw on your line of credit and must pay down the amount you borrowed plus interest.

Generally HELOCs come with a repayment period between 10 20 years attached. First the draw period which is usually 10 years followed by the repayment period which is usually 15 years. GET UP TO 500000 WITH A HELOC.

During your repayment period youll no longer have access to funds via the HELOC and will be required to make monthly payments until the loan is fully paid off. Others require repayment in as little as five years following the draw period. Some lenders require borrowers to pay back the entire amount at the end of the draw period and others may allow you to make payments over another time period known as the repayment period Cash-Out Refinance Loan.

You have to be prepared for this or the increase in your monthly payment which will now. The draw period and the repayment period. The rate youre offered will depend on your credit scores income.

During the draw period you can draw on your line of credit and only pay interest on the money you borrow. HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. HELOC amounts range from 15000 to 750000 up to 1 million in California and repayment periods are available in 10- 15- or 20-year terms after a 10-year draw period.

Age of the loan. In the draw period you can borrow funds from the HELOC and are only required to make interest payments and do not have to repay the principal. During this time you also have the option to make payments back against the principal.

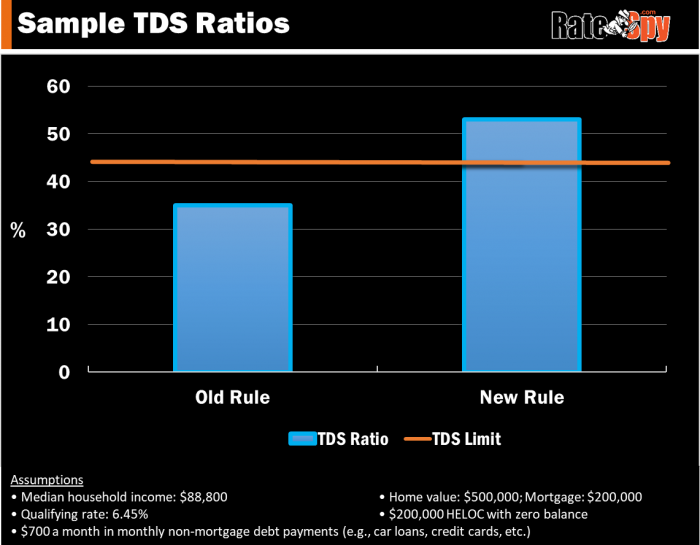

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Rates In Canada Homeequity Bank

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

Home Equity Line Of Credit Payoff Calculator

Heloc Payment Calculator With Interest Only And Pi Calculations

How A Heloc Works Tap Your Home Equity For Cash

Heloc Calculator How Much You Can Borrow Casaplorer

How A Heloc Works Tap Your Home Equity For Cash

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

How To Calculate Equity In Your Home Nextadvisor With Time

Heloc Payment Calculator With Interest Only And Pi Calculations Home Equity Loan Home Improvement Loans Heloc

Home Equity Line Of Credit Qualification Calculator

Home Equity Line Of Credit Heloc Rocket Mortgage

Best Current Heloc Rates Calculator Compare Home Equity Loans To Cash Out Refinancing

Looking For A Heloc Calculator

Home Equity Line Of Credit Heloc Or Home Equity Loan To Pay Debt

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)